Source: fibre2fashion

Lower lead time, eco-friendly and design flexibility are the major factors driving the growth of Digital textiles printing globally.

Commercialized in early 2000's, Digital Textiles Printing has revolutionized the textiles printing process in current time. DTP can be defined as any ink jet based printing designs onto fabrics with the help of digital based image. Since its introduction this technology has witnessed tremendous popularity amongst textiles printers across the world. It currently represents more than 1.5% of the overall printed textiles market which is expected to be more than 5.0% by 2020.

Digital textiles printing was initially used for soft signage applications, however with the advancement in the technology its applications diversified into textiles & clothing, home textiles and other applications such as tents, automotive textiles, boating products and many more.

Europe is the largest regional segment using DTP technology lead by Italy. The region accounted for 47.4% and 46.4% of the global DTP output in 2014, respectively in terms of volume and value. The region was followed by Asia-Pacific, North America and RoW with a respective market share of 26.7%, 15.7% and 10.3% in 2014 in terms of volume.

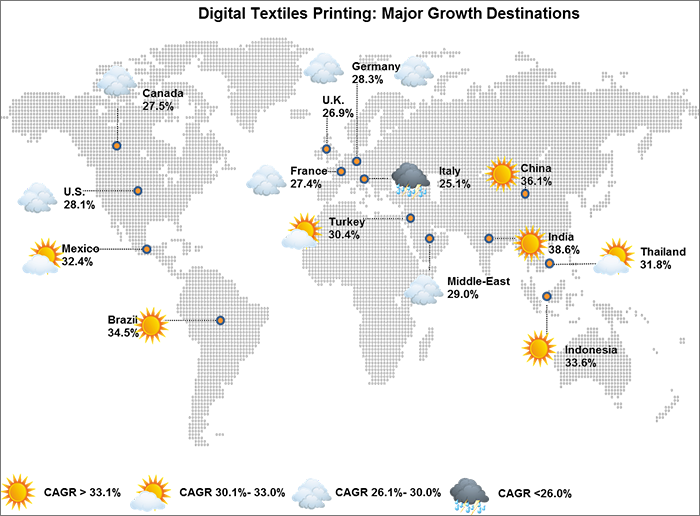

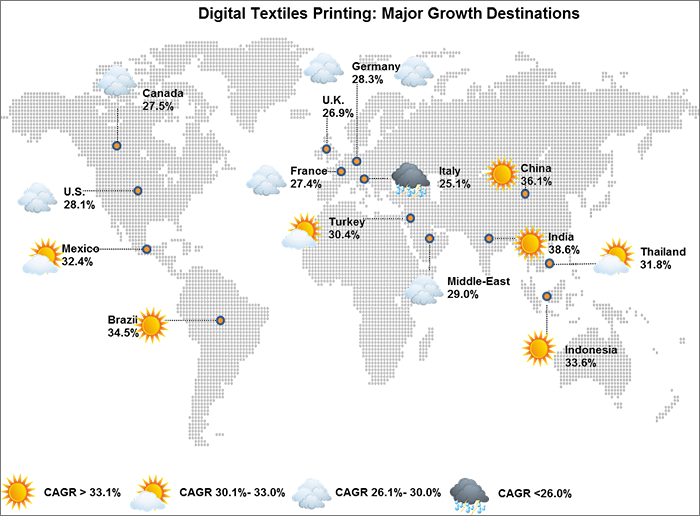

Digitally printed textiles output was around 563.2 mm2 worth $853.8 million in 2014. Digitally printed textiles output is estimated to grow at a CAGR of 28.1% in terms of volume to reach 2,519.7 mm2 worth $4,260.0 million by 2020. Asia-Pacific region led by India is expected to register the fastest growth amongst all the regions across all the regions. DTP output in this regional segment is expected to grow at a CAGR of 33.0% and 35.7%, in terms of volume and value between 2015 and 2020.

Applications of DTP technology segmented into four major categories, namely textiles & clothing, home textiles, soft signage, and others. Soft Signage application is the oldest and largest end-use application of the DTP technology. This segment represents roughly 44.1% of the market size in 2014 in terms of volume and is expected to be the second fastest growing market till 2020 growing at a CAGR of 27.7% in terms of volume. Textiles & clothing application held the second largest share, and projected to grow fastest with a CAGR of 29.4% in terms of volume, from 2015-2020.

Disperse & sublimation ink which is primarily used for soft signage printing applications represents the largest market share amongst all the ink types, this segment accounted for roughly 58.7% and 57.4% of the market size in 2014 in terms of volume and value. Pigment ink segment, which accounted for 2.5% of the market share in 2014 is expected to be the fastest growing ink segment and is expected to grow with a CAGR of 33.8% in terms of volume, from 2015-2020.

DTP has witnessed significant growth in the recent past and the trend is expected to continue in the future also. The major factor that is driving the growth of DTP are significantly lower time to market as compared to traditional printing methods, eco-friendly process, high design flexibility, reduced inventory obsolesces. Traditional textiles printing process takes around 6-8 weeks against 3-10 days taken by DTP. DTP helps textiles printers to eliminate the unnecessary steps and reduce the time in order to stay competitive in the fast changing fashion cycles which has also reduced the average run lengths across all the regions. DTP is also more environment friendly process consuming less power and water and leaving minimal industrial waste and CO2 emission as compared to traditional printing process, which makes it an ideal choice for the replacement of the traditional printing process taking into consideration its environmental impacts.

The key players in the DTP value chain are: Mimaki Engineering Company Ltd. (Japan), Seiko Epson Corporation (Japan), Kornit Digital (Israel), Sensient Technologies Corporation (U.S.), Electronics For Imaging (EFI) Inc. (U.S.), SPG Prints B.V (The Netherlands), Sawgrass Technologies Inc. (U.S.), Durst Phototechnik AG (Italy), Du Pont (US.), Dystar Group (Singapore), Huntsman Corporation (U.S.), Kiian Digital (U.S.) and many others.